As inflation continues to heat up, investors are searching for ways to provide a measure of protection. One possible safe haven is to invest in Series I Bonds (short for inflation bonds). This security combines the security of U.S. Savings Bonds with inflation-based returns.

Furthermore, investors in Series I Bonds may benefit from certain tax advantages. Notably, you can defer tax on the annual Series I bond income until you’re in a lower tax bracket.

Background: Series I Bonds are U.S. Savings Bonds, similar to the more common Series EE Bonds, that are backed by the full faith and credit of the U.S. government. So they are one of the safest investments around.

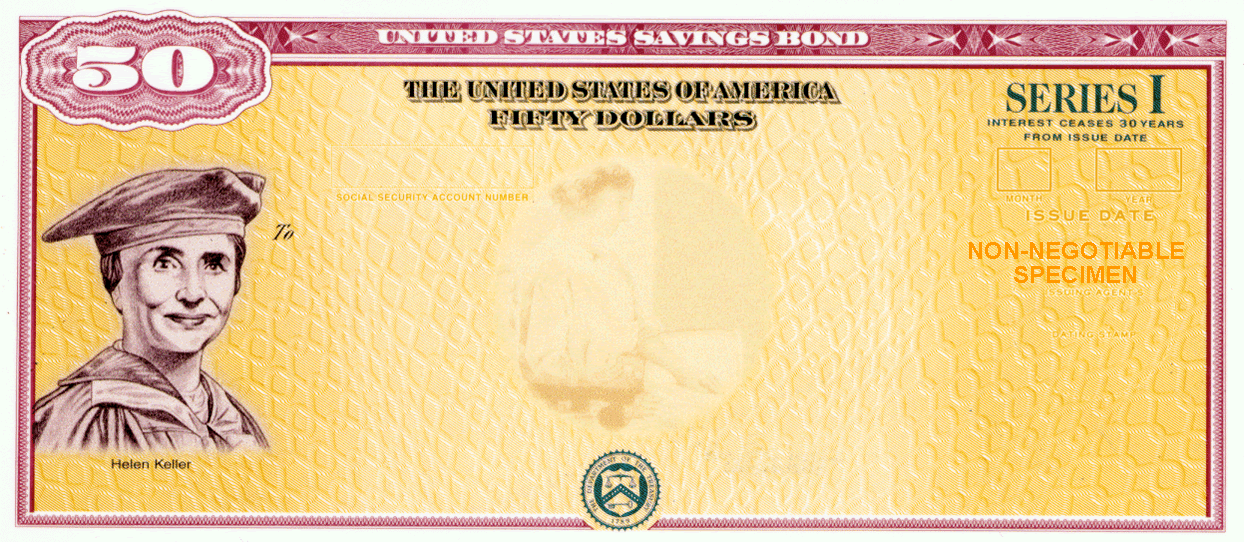

You can buy Series I Bonds online through the government’s Treasury Direct department at www.treasurydirect.gov or purchase them in paper form when you file your tax return. The cost is the same as the bond’s face value. For online transactions, you can choose any denomination, but paper purchases are restricted to only five denominations: $50; $100; $200; $500; or $1,000.

However, that there are annual limits on the amount of Series I Bonds you can buy during the year. The limit is $10,000 for Treasury Direct purchases and $5,000 for paper purchases for an effective total of $15,000 per year.

The rate of return for Series I Bonds combines a fixed rate and an inflation-indexed rate set twice a year. For example, the rate was 7.12% for the six-month period ending April 30, 2022. This makes it a competitive investment.

What about the tax aspects? This is where investors have some leeway.

Normally, investment income is subject to federal income tax on an annual basis, as it is earned. However, as with Series EE Bonds, you can report all of the income in the year you cash in the bonds or the year in which they mature, whichever comes first. This enables you to defer tax until a year when you expect to be in a lower tax bracket. Alternatively, you can elect to pay tax annually.

Moreover, you may avoid tax completely on Series I bonds if the money is use to pay for education, assuming certain requirements are met. The list of qualified expenses includes tuition and fees, labs and other expenses paid for a course required as a part of a degree program or certificate-granting program at a college or university.

The expenses must be incurred on behalf of you, your spouse or a dependent you support, like a child. The Series I bonds must be registered in your name for you to claim the tax exemption.

In any event, there are no tax concerns on the state income tax level. Series I bonds are exempt from state income tax regardless of their use.

Finally, note that you buy Series I bonds a gifts for others, like your children or grandchildren. This may be a good way to save money for college with some inflation protection. Consider all the relevant financial and tax angles.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs